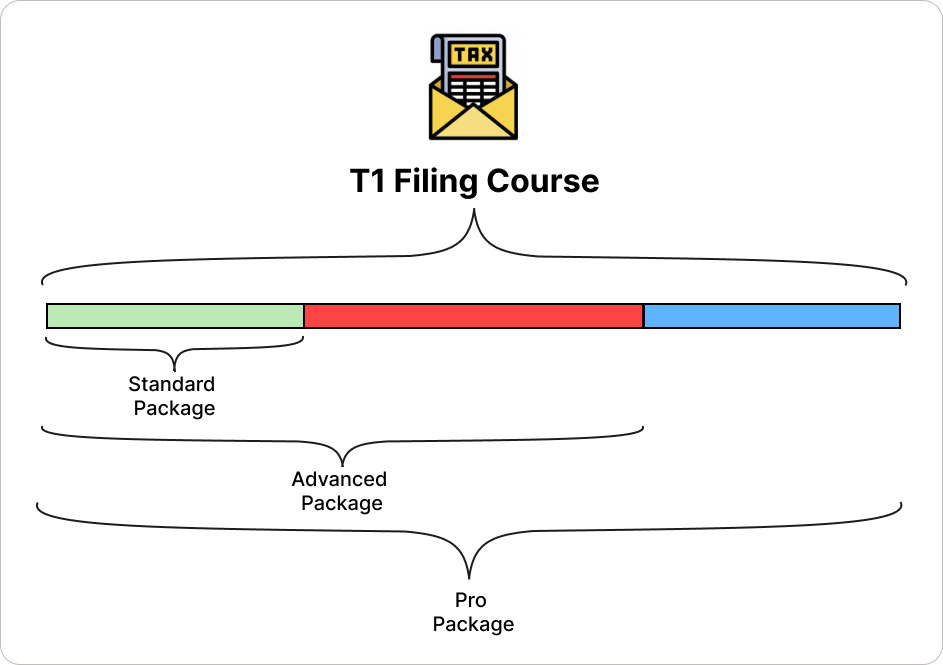

9 Lessons

21 Hours

Enhance your career prospects by standing out in the job market with specialized tax expertise.

Learn to provide strategic tax planning advice to clients, optimizing their financial situations.

By mastering T1 filing, you gain the power to control your finances, potentially saving you money through bigger tax refunds and smarter financial choices.

Gain in-depth knowledge and skills in Canadian taxation, with a focus on filing T1 returns.

9 Lessons

21 Hours

Gain a comprehensive understanding of the Canadian tax system with our introductory module. Learn about key concepts, regulations, and procedures to navigate the complexities of filing a T1 tax declaration confidently.

Uncover the secrets to maximizing tax savings through deductions and credits. Explore the various deductions and credits available to taxpayers, and learn how to leverage them effectively to optimize tax returns.

This module provides essential guidance on filing tax declarations for newcomer cases, easing the transition into the Canadian tax system.

Explore different types of employment income, such as salaries, wages, bonuses, and benefits, and learn how to accurately report them on tax returns to ensure compliance with Canadian tax laws.

Understand the unique tax implications and reporting requirements associated with earning income through commissions, and learn valuable strategies to effectively manage and optimize tax obligations.

Put knowledge into practice with real-life case studies designed to simulate common tax scenarios. Apply understanding of the Canadian tax system to analyze and solve complex tax problems, gaining valuable hands-on experience that will enhance proficiency in filing tax declarations.

21 Lessons

63 Hours

Learn about the various types of investment income, such as dividends, interest, and capital gains. Explore tax implications, deductions, and strategies for optimizing investment income on tax returns.

Understand the tax rules and regulations surrounding rental income, deductions, and reporting requirements. Learn how to accurately report rental income and expenses to maximize tax efficiency and compliance.

This module covers tax implications of earning income from foreign sources, including foreign employment, investments, and business activities. Learn about foreign tax credits, reporting requirements, and strategies for managing foreign income on tax returns.

Learn about unique tax considerations, deductions, and reporting requirements for self-employed individuals. Explore topics such as business expenses, income calculation methods, and tax planning strategies to optimize tax efficiency for self-employed businesses.

In this specialized module learn about Goods and Services Tax (GST) and Harmonized Sales Tax (HST) regimes, registration requirements, filing deadlines, and compliance obligations for businesses. Gain practical knowledge and skills to navigate GST/HST filing with confidence.

Put advanced tax knowledge to the test with real-life case studies. Apply understanding of investment income, rental income, foreign income, self-employed business income, and GST/HST filing to analyze and solve complex tax scenarios. Gain valuable hands-on experience and enhance proficiency in advanced tax filing.

24 Lessons

72 Hours

This module is designed for those aspiring to start their own tax preparation practice. Learn about business setup, marketing strategies, client management, and best practices for running a successful tax preparation business. Whether you're a seasoned tax professional or just starting out, this module will equip you with the tools and knowledge needed to launch and grow your own tax preparation practice.

Learn about the RepID (Representative ID) and Efile Number systems used for electronic filing of tax returns in Canada. Understand how to obtain and manage your RepID and Efile Number, as well as the requirements and responsibilities associated with electronic filing. Gain practical skills and knowledge to streamline the tax preparation process and ensure compliance with regulatory requirements.